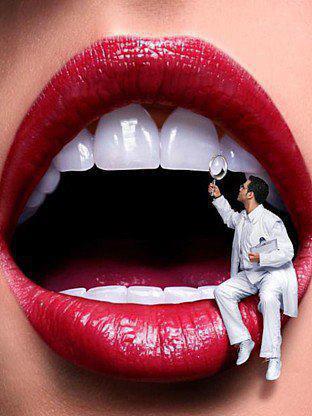

Dental insurance is one of the most popular supplementary insurance policies in the Netherlands. Not surprising, because your teeth are an important part of your body that you like to maintain. What does dental insurance entail and what is reimbursed or not? You can read that in this blog.

Dental care in the basic insurance

Every person who lives or works in the Netherlands is obliged to take out basic insurance. The care that is reimbursed under the basic insurance is determined nationally by the government. The basic insurance also includes dental care. A distinction is made here between insured minors and insured persons of age.

Insured persons under the age of eighteen are reimbursed for a wide range of treatments under the basic insurance. This includes periodic check-ups, tartar removal, fillings and surgical dental care.

Insured persons over the age of eighteen are only reimbursed for surgical dentistry, X-rays and removable dentures. This means that periodic dental check-ups are not reimbursed for adults. Just like the visits to the dental hygienist.

What is covered by supplementary insurance?

Many children have to deal with it in their puberty, the braces. This care is not reimbursed as standard from the basic insurance and must therefore be paid for yourself or partially reimbursed from an additional insurance.

For adults, basic care already falls outside the basic insurance and you can therefore take out dental insurance for this. What is reimbursed within the dental insurance depends on the health insurer. Each health insurer determines the conditions of the supplementary insurance itself. Preventive dental care, such as the six-monthly visit to the dentist, is often covered by dental insurance. Additional treatments, such as filling cavities or placing prostheses, are also partly reimbursed. As an adult you can also use orthodontics and this is also partly reimbursed.

Partly reimbursed

Much additional dental care is partly reimbursed with additional health insurance. The rest of the amount falls under the personal contribution that you must pay as an insured person. This personal contribution is similar to the compulsory deductible that you pay with the basic insurance. The mandatory deductible is at least €385. The personal contribution, on the other hand, is variable and depends on the dental care you need. For example, orthodontics is reimbursed up to sixty percent and you pay the other costs yourself.

Dental insurance required?

Do you have healthy teeth and do you go to the dentist twice a year for a quick check-up? And don’t you use additional care, such as sealing cavities? Then dental insurance may not be necessary for you. You will then save money by paying for these visits yourself.

Do you know that you will soon have a crown treatment on the program? Or another major dental procedure? Then it may be interesting to take out additional dental insurance in advance.

XO Frieda

0This blog post contains products that I received.

Leave a Reply